If you watch athletics then you will have seen the look of absolute dismay on the face of a runner when they hear the second gun, indicating a false start, and they know that’s their race over. The months and years of work to build their bodies into the best possible shape, the work with coaches and the absolute dedication to a strict diet, all for nothing.

For athletes, it is a rare occurrence, although devastating when it happens. For business owners, however, it is decidedly more common when it comes to selling your business – and can be even more devastating. But it doesn’t have to be this way – in this article we look at some of the more common reasons for making a false start on selling your business and how to avoid them.

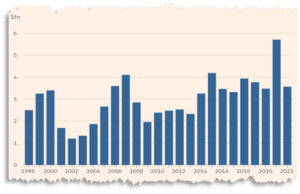

Source: Refinitiv

Fear of missing the boat

If you track M&A activity over the past 25 years, you can see that there are definite peaks and troughs in the total value of deals, which might lead you to make understandable assumptions about when is a ‘good time’ to sell your business. However, it’s not that simple.

Firstly, this sort of analysis can never give you the complete picture. The figures may be distorted by a handful of very large deals – or by an unusually high volume of deals, such as 2021 where we saw a “post-Covid catch up” effect.

The second, and most important, point is that while we can analyse the past, predicting what will happen in the future is somewhat less scientific… Selling a business can be a lengthy process and it is entirely possible that the wider M&A market will change over the 9-18 months between starting the process and concluding a deal.

What we can say, with absolute certainty, is that a good business will sell – a business that is growing, with a strong client base, scarcity value, recurring revenue and future potential. It is equally important that you are ready, both for the emotional roller-coaster ride that you are about to embark on, and that you are certain this is the right decision for you financially.

So, to avoid a false start, I would suggest you ask – is my business ready and am I ready – before you ask – is now a good time…

Lack of preparation

Entrepreneurs Hub will typically take 2-3 months intensively preparing your business for sale before approaching the market. Selling your business is not like any other transaction you will have done before and therefore requires a different level of preparation. From the documentation and financial planning to the gathering of information for due diligence it is something that catches a lot of people out.

Properly preparing documentation and finances is something that makes a real difference to the chances of achieving a successful deal completion, as this Fortune 500 acquirer from the US commented:

“We have struggled with deals that once started didn’t make sense… Often documentation and finances were not in good shape… Entrepreneurs Hub have made a difficult process really smooth. You are the best sell-side advisory we have worked with yet.”

Taking your eyes off the ball

Selling your business can become all consuming, especially if you are trying to do it yourself or aren’t getting enough support from your advisor. The false start here is possibly one of the most frustrating that you could experience.

You could run a text-book approach to market and come out with excellent offers. However, when you get to due diligence things start to go wrong. You’ve been so focused on selling the business that you didn’t realise that costs have been creeping up and sales have been falling off – your growth forecast that looked realistic 6 months ago, now looks over ambitious and the acquirer is asking some uncomfortable questions.

The remedy to this false start? Work with a trusted advisor who will run the process for you and allow you keep driving the business forward as if you weren’t going to sell it.

Unrealistic expectations of value

Valuation is a tricky subject that we don’t have time to fully explore here, but one of the biggest stumbling blocks for a deal is if offers don’t meet with the expectations of the shareholders. So, what can you do to prevent this false start?

Understand what you need. Understanding the amount of money that you need to do all the things you want to do is a really good place to start. Speak to a Wealth Management advisor about your lifetime cashflow. It can be really helpful to put any valuation you do get into perspective.

Secondly, get a valuation range. While we would stop short of placing a value on your business and we can’t make any guarantees – we will give you an indicative value range, an honest appraisal of where we expect offers to land. And if this falls short of your expectations, we can work with you and your business to close the gap before you go to market.

Inexperience

You know how to run a successful business, but have you ever sold one before? For a handful of you the answer may be yes, and that’s great, but you will also know the value of volume in experience. As a team, Entrepreneurs Hub has experience of well over 300 transactions which includes buy-side and sell-side experience.

An advisor who brings this kind of experience to the table is invaluable in helping you get the approach right and maximising your chances of a successful outcome when it comes to negotiate the sale. Of course, your acquirer is likely to have completed several transactions and will be well experienced:

“We could never had sold the business without the help of Entrepreneurs Hub. Even the company that bought us and had experience of several previous acquisitions complemented us on how professional and organised and easy to deal with our advisors were that made the whole process very smooth.”

Rolf Howarth, former owner of Square Box Systems commenting on the company’s sale to Nasdaq listed acquirer Quantum.

If you found this article helpful, you may be interested to read our Guide to Selling your Business in 2024.